How I personally choose my flow plays from blackboxstocks

Any options flow specially ones that are alerted on the flow app I always look at the chart

I do my analysis within <30 seconds as I know exactly what I want to see. I will show you in the following.

Yes I’m aware other traders blindly follow every flow. I get it and we all have reasons. This is what works for ME and may not work for you. I have put data with screen time that I have in the last 18 months mixed with my emotions to figure out how it is catered for me.

I cater my own trades like how a brewer crafts their beer.

There’s only a “few criteria” that I will blindly buy on the spot.

Exceptions as follows:

1. Known ticker to work historically (by experience only) : I’m always on the screen and know what comes in and what comes out of good flow. It will take you about 6-12 months to get a hang of what tickers get hit and what doesn’t. You’ll also learn the personality of the stock.

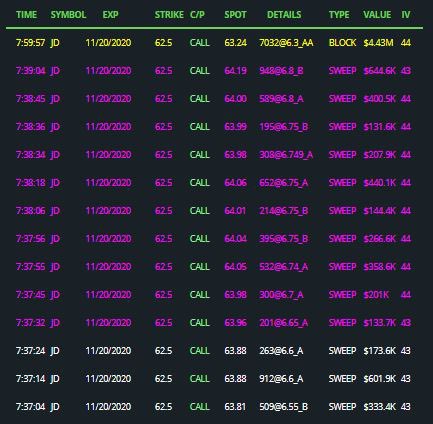

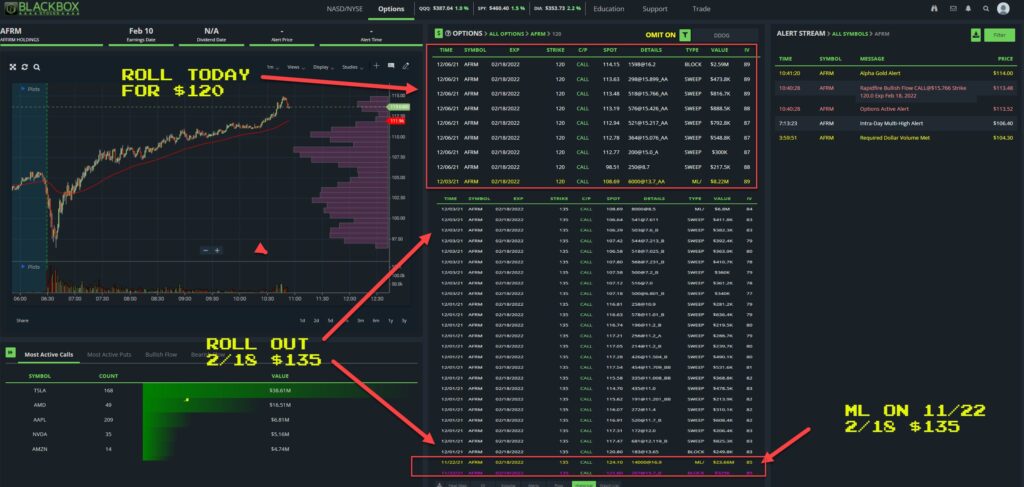

2. Structure of the flow. I love these ones and blackboxstocks used to call them 20-trades but a few failed out of 90% win rate and traders went too crazy. When you have this buying it’s a no brainer. The AA huge block at the end is the cherry on top for me

3. Dollar amounts total over $2M. As you can see the image above is perfect and it’s well over my own threshold

4. Contract prices over $4. This is just my own personal preference and I don’t like them under $4

5. Swing play with at least 3 months out. I love time

Now for 90% of the good flow..

below is my complete analysis on what I do within 30 seconds

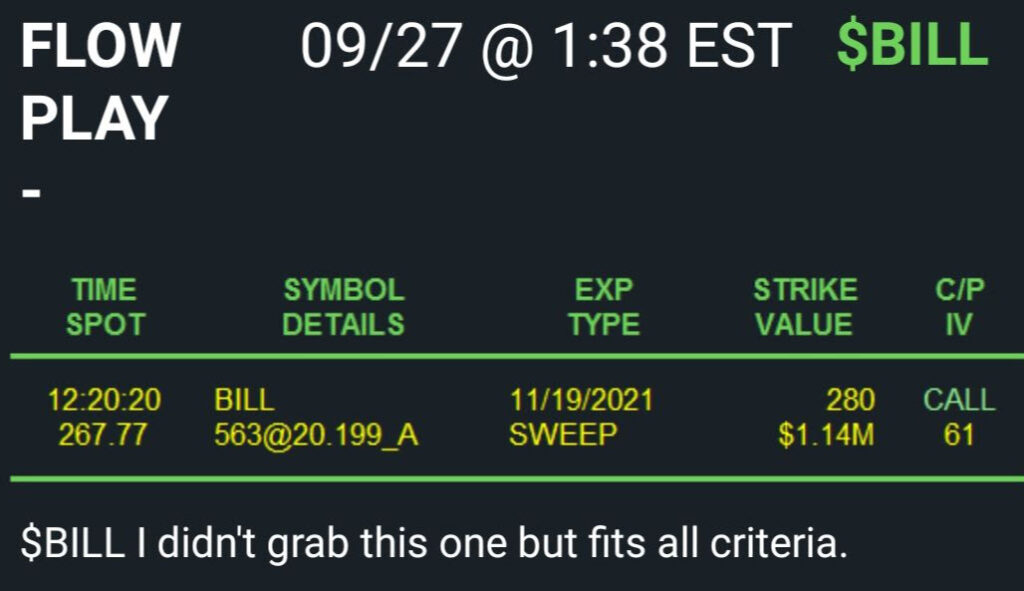

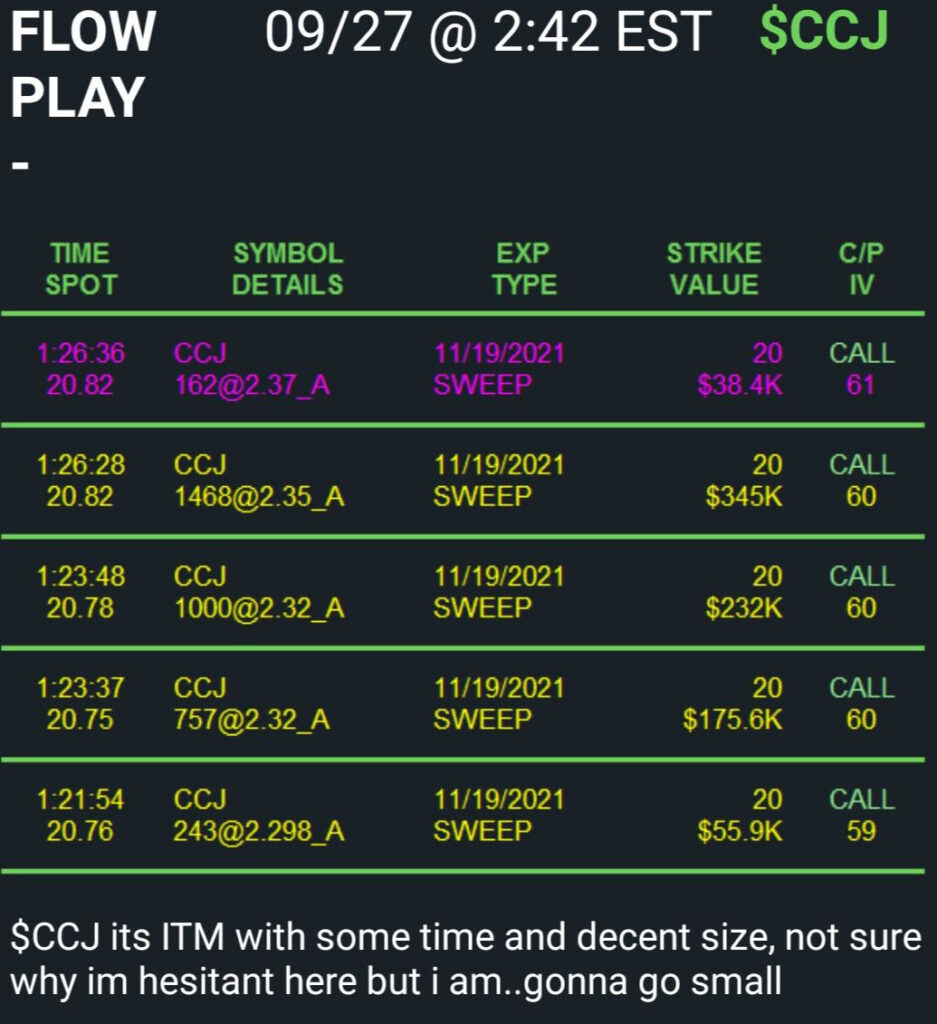

Not all flow will be clear cut as above and what I mean is examples like these ones. These flow are considered very good but I feel more comfortable taking a peek on the chart. For example if I saw the flow above and I’m buying lunch not in front of the computer, I will buy it. However if it’s flow like the following I will do my DD BEFORE I buy it….get it?

FIRST STEP:

- How far out is the play? When does it expire?. Further out tickers I tend to “average” in my plays. If it expires next week I’m not going full and may only position size 1/3 to 1/2 my regular position. Or 1 contract.

- Is the play ITM/OTM? If it’s OTM I put in consideration when the contract expires. If there’s time I will play it but if it’s to next week I may change the strike to a lower one IF there is volume. I’m NOT going to play A $1M sweeper that expires next week that is also OTM. It may work but not my cup of tea. I may play it closer to the money.

- Does it hit ER? The ER tells you when to get out as I do not play ER. If ER is in 2 weeks you need to remember you MUST get out of it in 2 weeks. If it goes through 1 or 2 ERs we are golden! Over 6 months flow hits 2 ERs

- Is this a familiar ticker? Did it work last time? Only by experience I cannot teach this on the blog. You must be on a flow options platform to figure this out. Historical are ONLY used as a guide. Just because it worked 3x in a row DOESN’T mean it will work a 4th time.

- Can I afford this? I know a lot of you play $500/$1000 contracts. But if a contract is $3k why the hell would you play it? If it draws down $1k you’re technically at zero on your original plays. This is BAD risk management. As a note. I do not like playing “flow” contracts over $3k due to my account size and I like to play multiples as I can scale “in/out” of the play. My account can afford it BUT just because you can, you shouldn’t. You will wreck your account if you do not follow this rule. Another side note, I do play AMZN/TSLA where contracts are up there. However these have pre-determined stops. I will not blow up my account because I will stop the trade when it hits my dollar threshold.

SECOND STEP:

*Assume everything above checks out

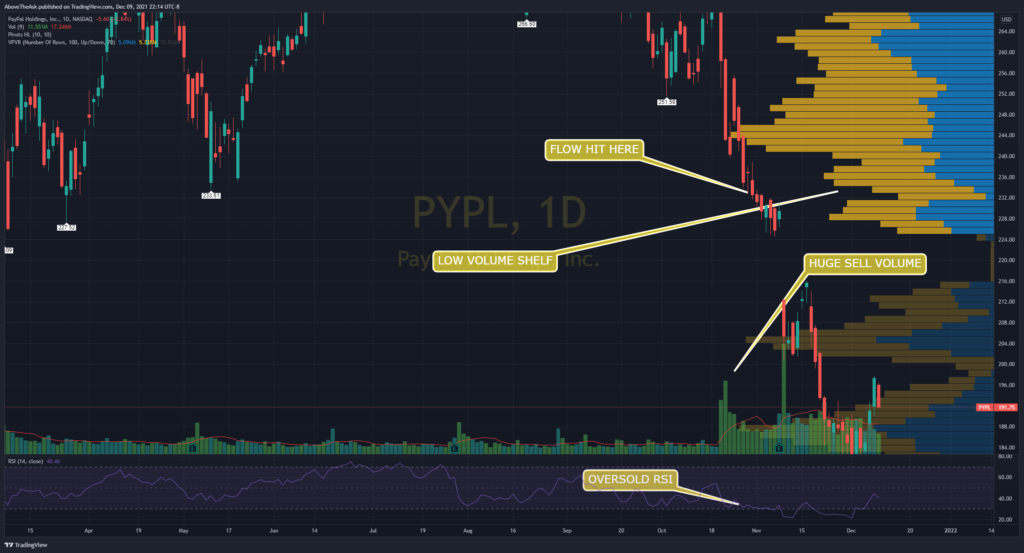

- What is the current pattern of the chart on the daily. Is there a Double Top? Double bottom? Pennant? Flag? Break ATH? Break current support / resistance?

- If there’s nothing obvious, try different timeframes as Weekly/daily/4hr/1hr/13mins etc whatever you’re used to using and find a pattern somewhere.

- Darkpool. Is there a darkpool area? Remember we use these are support and resistance.

THIRD STEP:

- If you still don’t find any pattern or trend you will have to guess what the pattern or trend it’s trying to be. But for our example of BILL you can see there was a trend line below. Now let’s assume we find something.

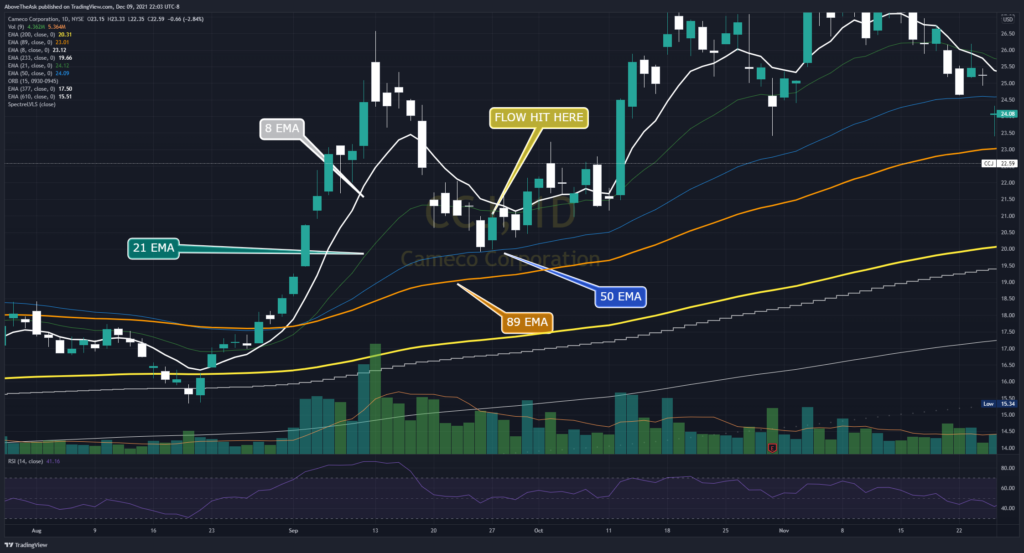

- Next up I use the moving averages as my indicators. I personally use 8/21/34/55/89/144/200/233/610. I have them all but I do not have them on all in the same time. I try to find which EMA -or- SMA they are in. Because if you see CCJ hit the 50 EMA when I had 55EMA so I had to adjust. Doing this will also show you where a possible drawdown. In this case it can drawdown to 89EMA.

FOURTH STEP:

- Now we have some basic confluence that the big money uses. I take it another step to see RSI/VOLUME profile.

FIFTH STEP:

- Risk Reward and prediction where stock will go.

- You can make educated guesses where a stock may go. DPZ for example they hit these at a very low point with size with about 5 months in the contract. In that 5 months is it possible for it to go hit ATH? For this ticker yes it’s possible. Are you going to wait for it to hit ATH then sell? Of course not, you’ll take profits on the way up. But you can see that the stock dropped -17% in 85 days. It was a slow bleed down but there’s not a lot of volume in those areas so it has the potential to move up with buying pressure.

- You also know if your contract price drawdown 50% you have 5 months for it to recover so intraday moves down shouldn’t scare you. That’s why you buy time.

With everything put in consideration by this time I already know what

Here’s what my full chart and it will look confusing to everyone but it takes only a few seconds to analyze it quickly

POST TRADE:

At this point I have already bought the option flow if it has already gained my interest.

A few bonus items I look to reconfirm are:

- Twitter/BBS input. There’s so much additional data that some of the traders I follow may have a different take and I will put it in consideration if it makes sense. These are as spec/predictions as what I just did. I search for the ticker name using $(insert ticker)

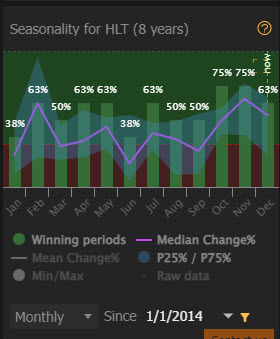

- Seasonality. I use trendspider’s tool but use it as only “spec”

- News. With news, it can help or go against you. This indicator I don’t use it unless it’s a day scalp as we can have a huge green or red candle but I get out seconds later.

- OI – Open interest. If the flow is good enough with no suspected flow I won’t check it the next day. I use OI to see the current status of the whale.

- ML/ROLLS– I like to see if there was anything in this name. I want to know if the whales rolled up or down. This tells me they were already bagholding it.

Final thoughts:

There is not one strategy that will work for everyone. However it’s good to see what a lot of people are looking at as this is points of interest. I will just put out that you need to be thoughtful of where you’re placing your trades. It’s always good to see where it is on the chart as you know the possible risk to a drawdown and you can see how much higher the stock can do. Use these tips as a way to supplement what you’re already using now.

If you’re new , I’d recommend reading up on what I have posted above. Youtube and investopedia is always a good learning tool. But always be weary on who you follow for tips on youtube. There is not one golden indicator.