4 Reasons why I use Charting Options 5 months in review

The most difficult in joining groups online is there’s usually barley any reviews on them. You have to depend on the social proof. Even then it’s very difficult. I don’t join much groups as I do not trust a lot of them. Going to be honest, it was difficult for me to even join ChartingOptions .

I seen his posts before and he had some very good plays in the past. You also need to remember these are just recommendations and should never be depended on. I had @OPTIONMAFIA1 give him a good word so I decided to join. Again the worst possible case is I lose $35 for a full month. I already lose $35 when I enter trade 🙂

At the time of this post, I have decided to write a FULL review which will be broken down in smaller chunks because 98% of you have the attention span of this guy: (I’m kidding)

This will be a 2 part review.

Stayed tuned for part 2

…At a later time…..in the next few weeks.

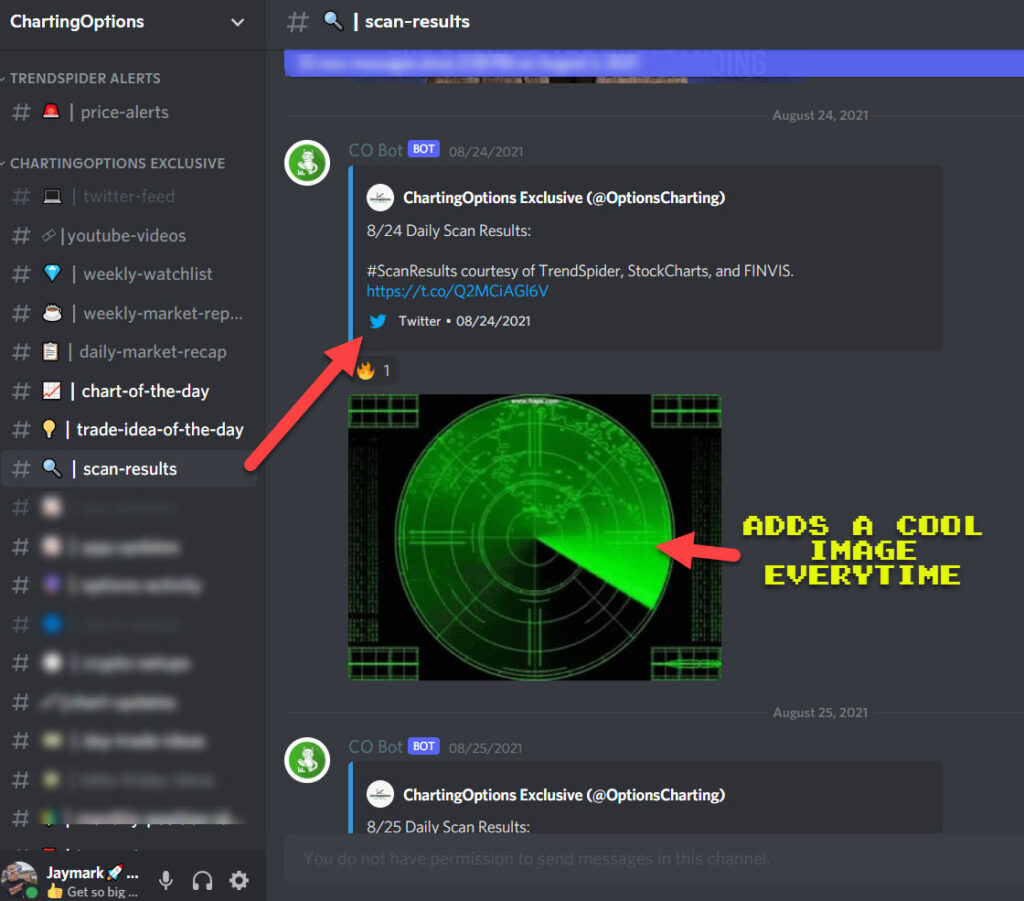

Everything is posted on his private twitter page. The twitter page is also connected to his discord to organize it. It is a bit confusing in the beginning but you’ll get used to it.

Here’s the main reasons why I use the service: (CONS at the end)

Weekly Watchlist / Discord organization

Market Recap

Scan Results

Lotto Fridays

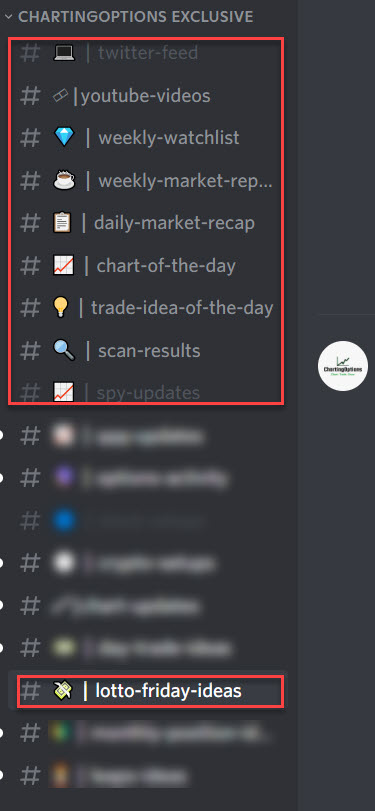

Below is a snippet of the categories. This is your main driver as all the tweets are posted here to navigate. All the information is listed here but you must go on twitter to see everything else.

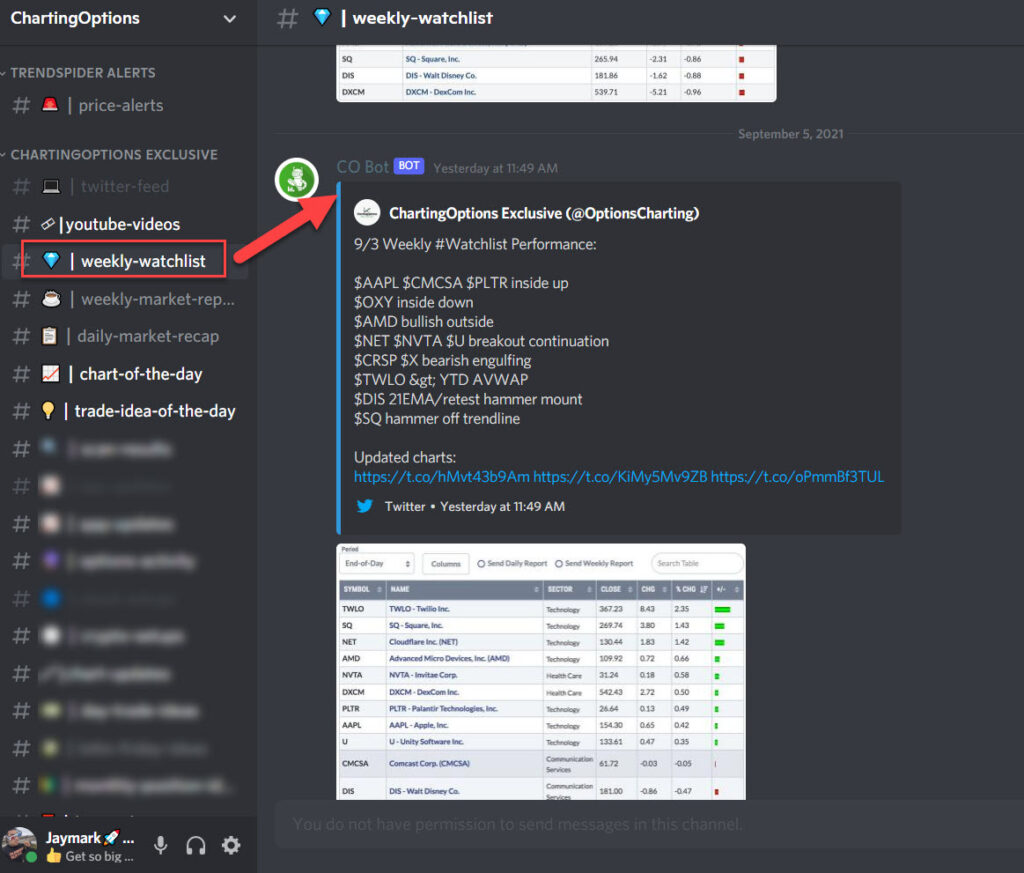

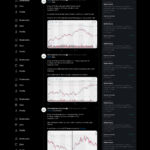

Weekly Watchlist

CO gives a list of tickers that you will watch for the week. There will also be recommendations on entries and which calls. They are mainly swing plays so you’re purchasing monthlies. However you can also play the weeklies but this is up to you. During the week there is an update posted on how the stock tickers are doing for that watchlist ticker.

How I use this: When this is posted, I take about half an hour to read over the thread. I write it down and chart the lines with alerts on ones that I personally feel has a high confluence. I’m not new to reading charts so I know what fits my style. If I saw there was flow in the past then I may play that strike/expiration. *If I have a very high confluence I usually go on my options chain on the strike/expire with a limit order of .01. So when I want in, I just change the value right away before it runs.

This is usually posted on Sunday nights

Here’s what happens when you click the link and it will go into his private twitter account.

*Click on small thumbnail above to see full thread

WARNING huge image, you need to download and zoom in*

Updates are posted as the week goes. He re-tweets it

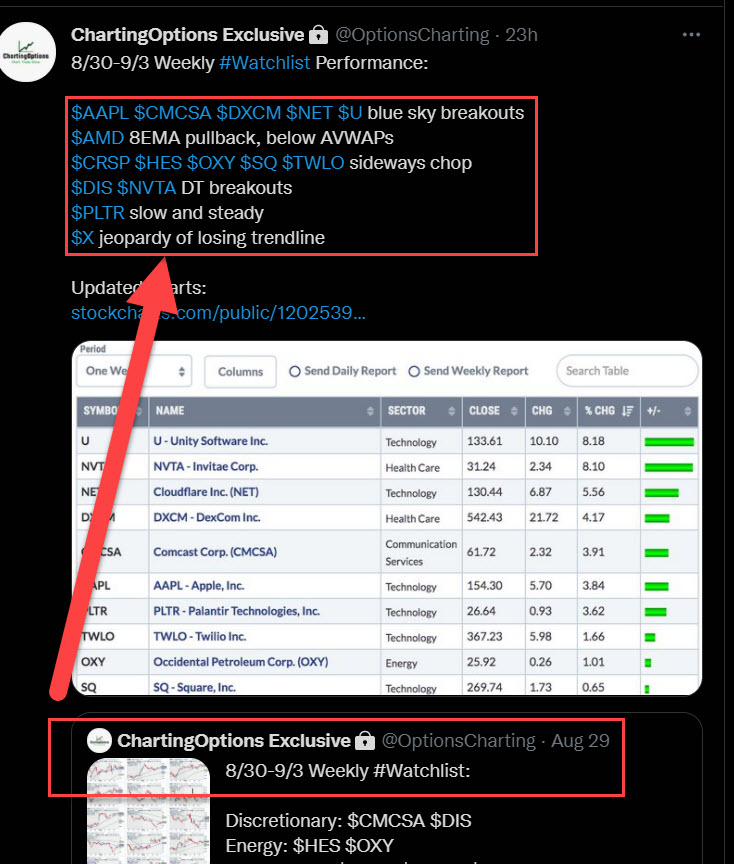

Now this is where the organization in discord comes in perfectly. Instead of going on twitter and scrolling, you can just go on discord.

Market Recap / Youtube

The daily recap & market updates is something I use personally just to give me a brief overview. I have other sources that I use but I like a summarized version of it and CO does cover this.

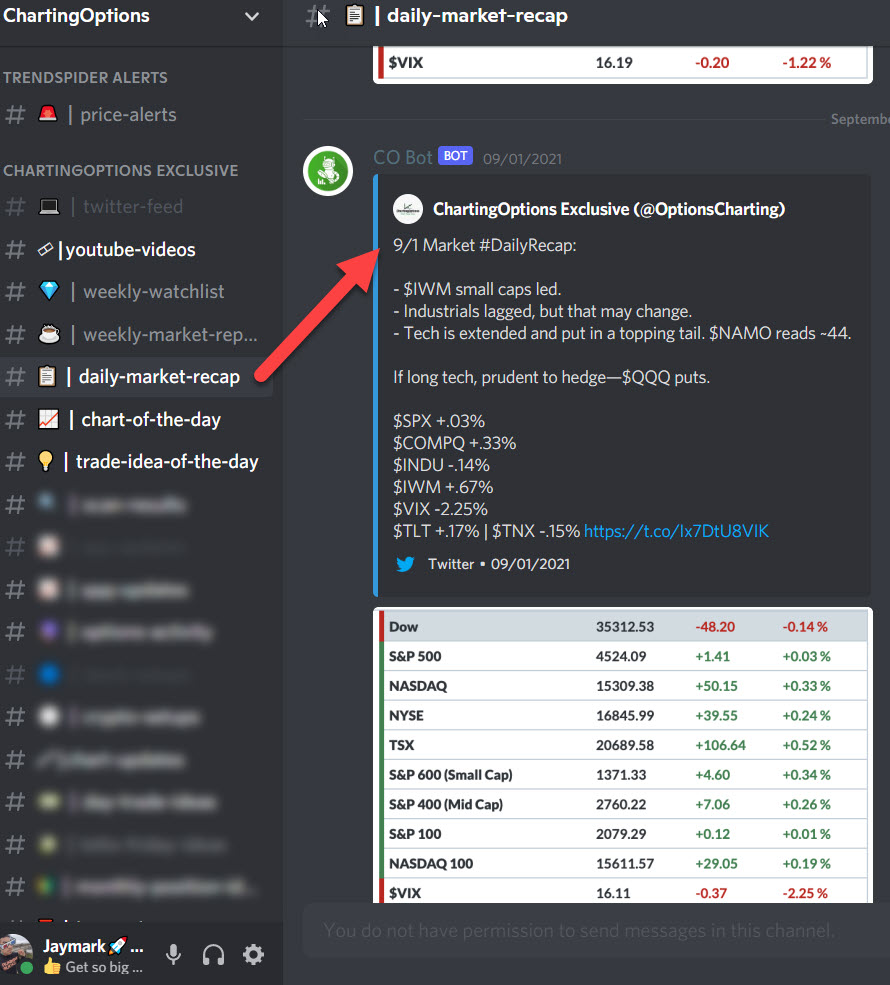

I watch $SPY all the time and this helps me see what is going on.

In the recent weeks he also has started to do recap videos on the flow trade that he has taken. The videos are private but here is one that is public and goes over the play. So he speaks about the why and how about a specific play. I’ll be honest, I barley watch these. NOT because I think it’s irrelevant, I need to limit myself to, “too much information”.

But for a beginner 100% I think you should watch these.

Below is a sample of playing $HLT (Hilton)

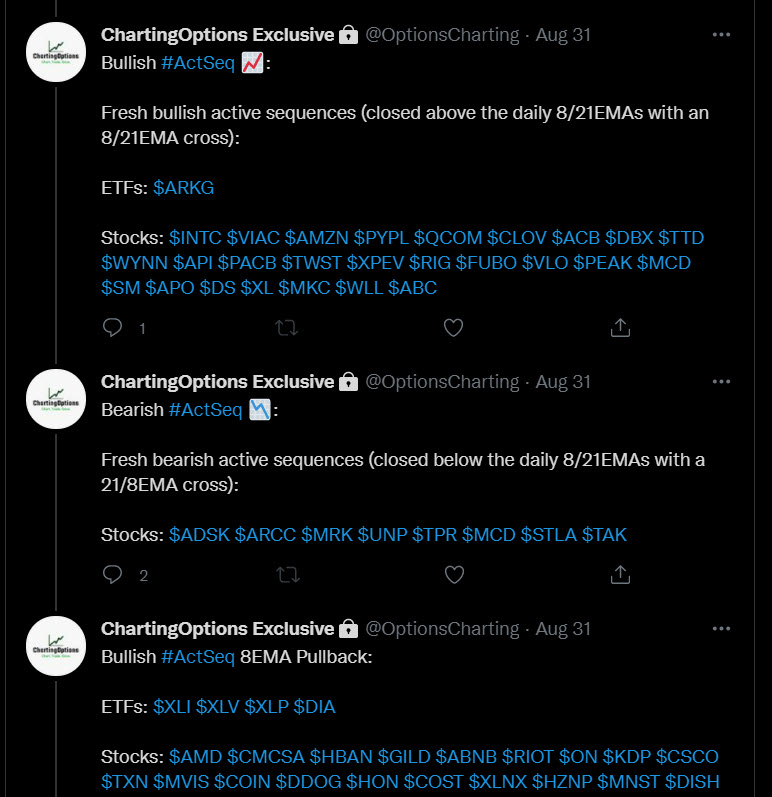

Scan Results

This one is really, REALLY spot on GOLD. He sets up the parameters using Trendspider and gets it summarized.

When that link is clicked, this is what you see. Notice that everything is set up in a very clean format. These are taken from the scanner and it’s true that you can do it yourself but saving time is very important right? Some of these can also be played depending on what was posted on these in the last few weeks. You may have a better entry.

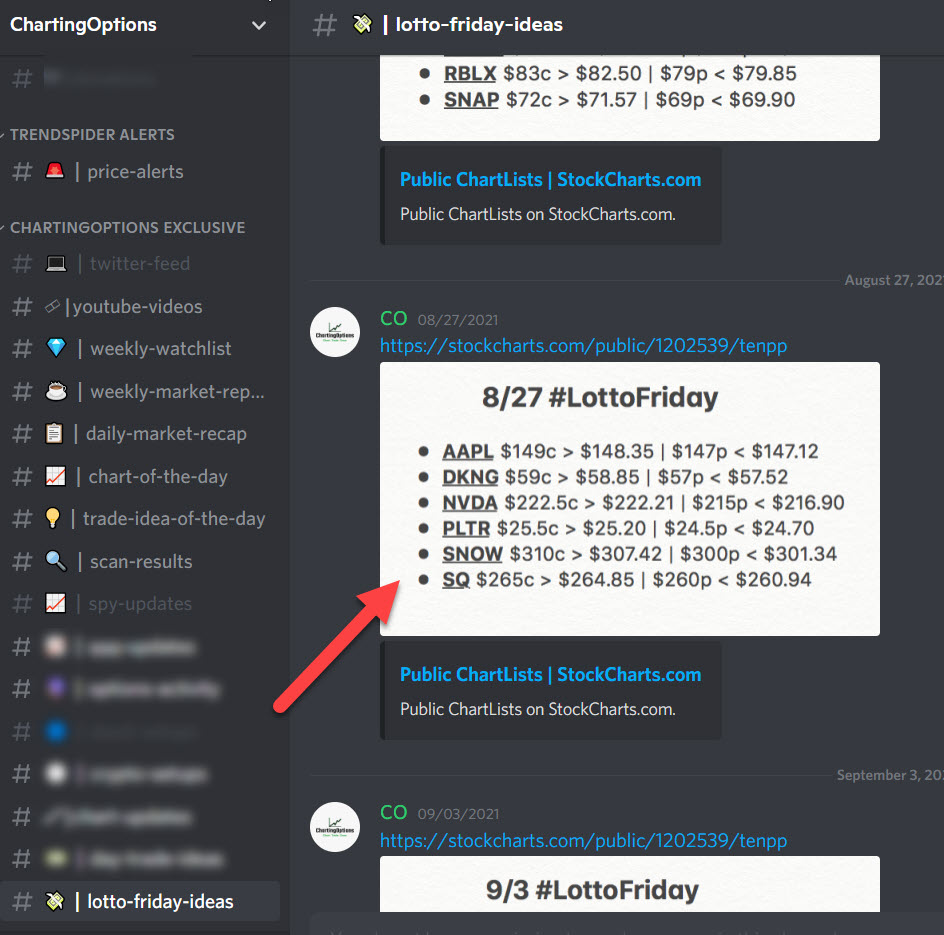

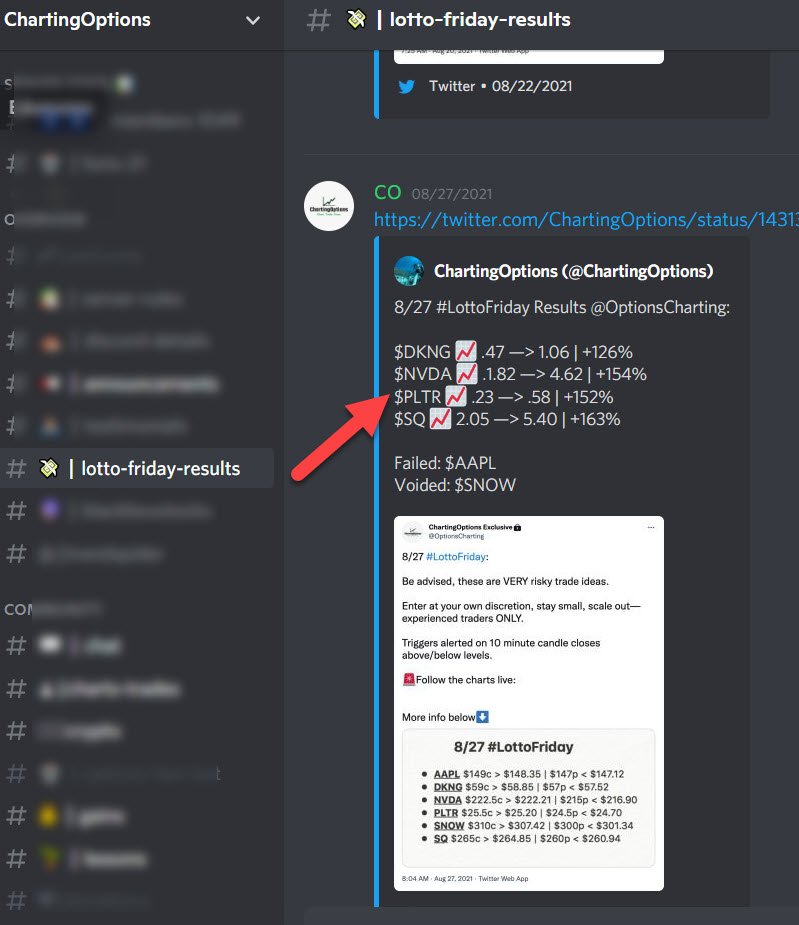

Lotto Fridays

I love these ones. These plays are never EVER 100% to make money. It is always a gamble. The money here is for same day expiration and cheap. You should always expect to lose it all. If you’re up for the week play these. If you’re RED for the week you better think twice.

These are posted on Thursday night or early Friday

Once Friday is over, the results are posted (public): https://twitter.com/ChartingOptions/status/1431394674003091458

The cons

*Only applies to what was said above*

Watchlist – I find nothing wrong with these watch list. They are great and we get the updates. However the only drawback is , if you’re 0 experience brand new to trading, these charts will make no sense to you. My suggestion is do research, take some free classes and you’ll understand it ”. Note there is an education channel but I did not go over it today.

Market recaps – They are great and gives concise information.

Scan results – Epic gold here. I love these scan results. This is too good to even be here.

Lotto Fridays – Can’t really complain when its labelled as a lotto with a very good track record. Same thing as complaining to the casino because you lost money. It does it’s job and more like a bonus.

Biggest con for what I spoke about? I would only have to say that if you’re not already on twitter AND discord, you will have a hard time. I know less tech savvy people may have a harder time putting the information together. For someone who is tech savvy is not a con, as I do like being on discord / twitter.

Cost / Value & Summary

Comes out to roughly a bit over $1 day at $35 bucks a month. The value you get surpasses this by far. It is a small cost that is well worth the money. This doesn’t even include all the other services that he adds. Remember this review was only 1 out of 2 it. There is more to the service.

In the meantime, if you’re still not convinced you can wait for the other pieces that I haven’t reviewed yet. But just the scanner and the watchlist is pretty much worth the $35. It takes work to put this stuff together and it’s true you can put this together on your own. But the amount of work is a ton and I believe it’s price point is golden.

Also remember that he does use BlackBoxStocks , it is not required to use it but it sure does help a lot.

I’m reviewing this since I’m a fan of the service. I don’t make money off reviewing ChartingOptions. I just traded a bunch of his trades and paid for a lot of stuff.

I enjoyed this as I am a new member…helped me focus in a on a few things like Scan Results section – thanks for highlighting.

Great to hear and thanks for reading

Great review. Thank you.

thanks for reading!

Thanks for the write-up I will definitely check it out!

Thanks for reading Bryan!