6 Examples of bid side flow you thought was a sell

Countless times we see good flow that fits our textbook plays. There will always be someone complaining about the flow flipped minutes later when they got in.

Think about it first. So smart money will dump $1M for example for a monthly contract and sell it 2 mins later for a very small gain? A weekly contract, I can understand but this is a different story. Even weekly they get out the following day. I believe it was only once we spec they got in and got out for a scalp which was very clear.

Try BlackBoxStocks.com and get 20% off First month!

Here’s a few tips then we’ll go with examples.

- If you believe it’s a sell then move on and find another ticker. Just ignore the million dollars and go on with your life. Get off twitter and discord because you’ll end up not winning your argument as everyone’s opinion will remain unchanged.

- We have data that supports it and is rarely a sell when big money comes in with ask side and bid sides. They don’t make money off a few damn pennies. They don’t. I seen them just roll down or just take the L days/weeks later.

- Let’s say there is no bid side and it is all Ask and Above the ask with sweepers. Even though a lot of money came in, it still does NOT guarantee the flow will work. So don’t forget that all flow is never 100% wins.

- The final verdict would show in the following day’s OI.

I’m not mocking anyone and if you need HELP please reach out to me or another Blackboxstocks member. It took me months to figure this very simple concept. Eventually it will be second nature. If you’re new take the time to learn and experience it. There is no substitute for “seat time”.

See below for examples:

*Bonus: Scroll to the bottom, I showed an example of big money exiting.

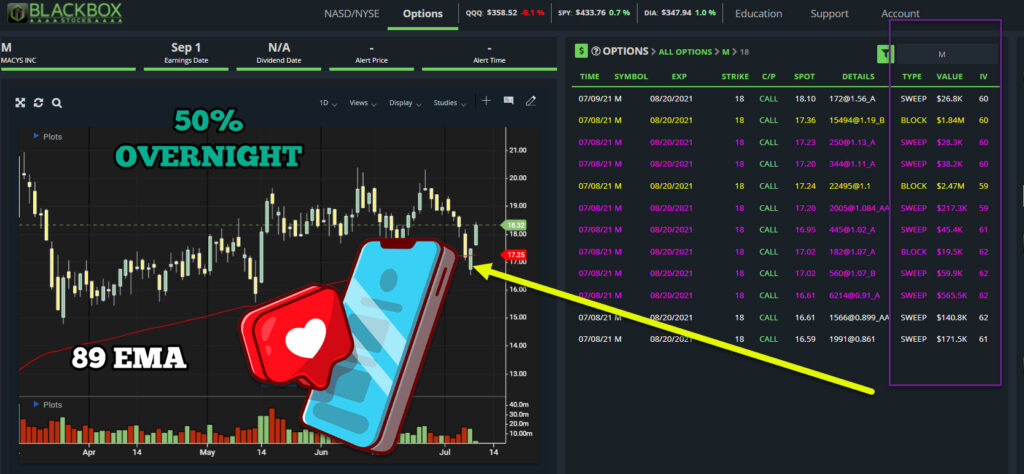

MACYS – Original Post: $M

I couldn’t get the time stamps on these but even without the time stamps, you can see the flow was spot on. No one would sell 1.84M for a profit of 8 cents. Really guys??

Next day it went up 50% gain

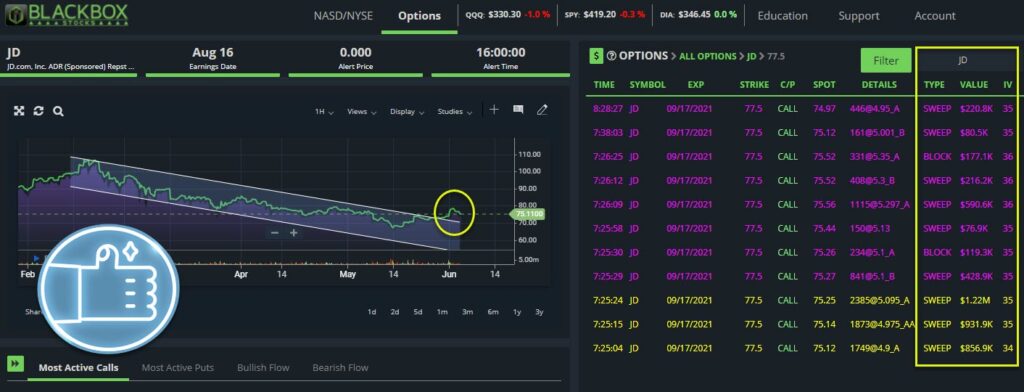

JD – Original Post : $JD

These had a huge drawdown but they are in the position. Look at the 3rd line, $1.22M and we had people saying they sold 5 seconds later. No one added $1.22M then sold for .005 cents $429.9k .

These were up 35% gain

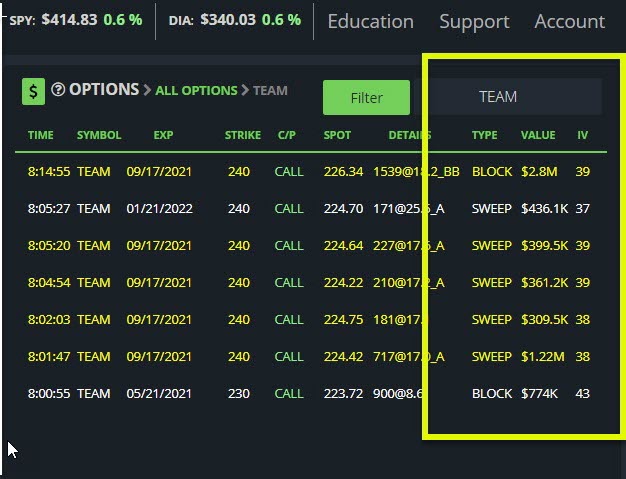

Atlassian Corporation PLC – Original Post : $TEAM

Look at this old flow on 4/21. Huge below bid side. This is an old flow I posted back in April.

Big money did not buy 1.22M + all the ask side = 2.2M and sold $2.8M about 9 mins later for a measly gain of 7%. Here’s the chart updated chart where this specific flow was entered vs today (not yet expired)

Do the math on gains 🙂

Get 20% OFF First month with Blackboxstocks

ANAPLAN INC – Original Post : $PLAN

Big money kept adding to this ask side to $1.6M. They did not sell it for a gain of 30 cents. No way. Sorry this doesn’t happen. I got out early but the option flow worked. See my post below.

These were up 83% gain

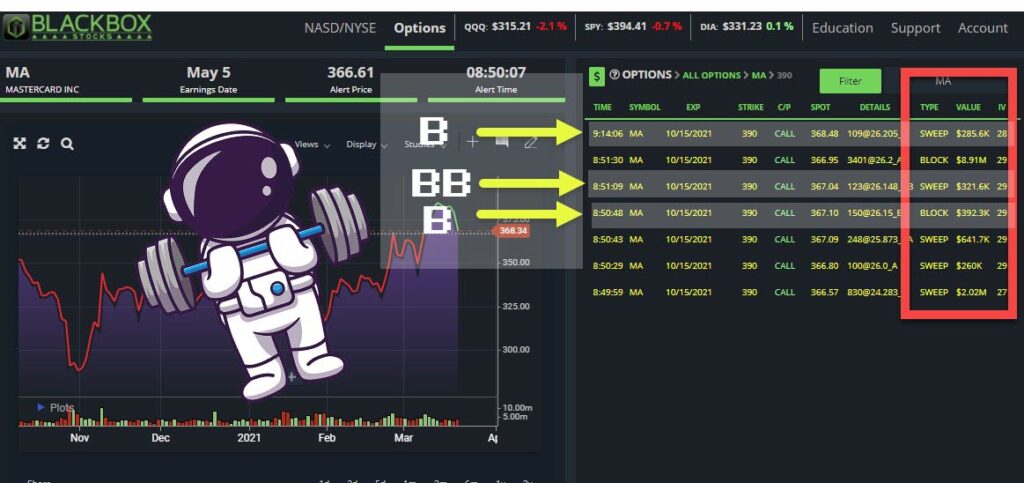

MASTERCARD – Original Post: $MA

See the bid side, sorry it was covered by the red highlight. I just didn’t care at the time because I didn’t realize there would be so much hate on bid side with the right flow.

Up a modest 31% gain

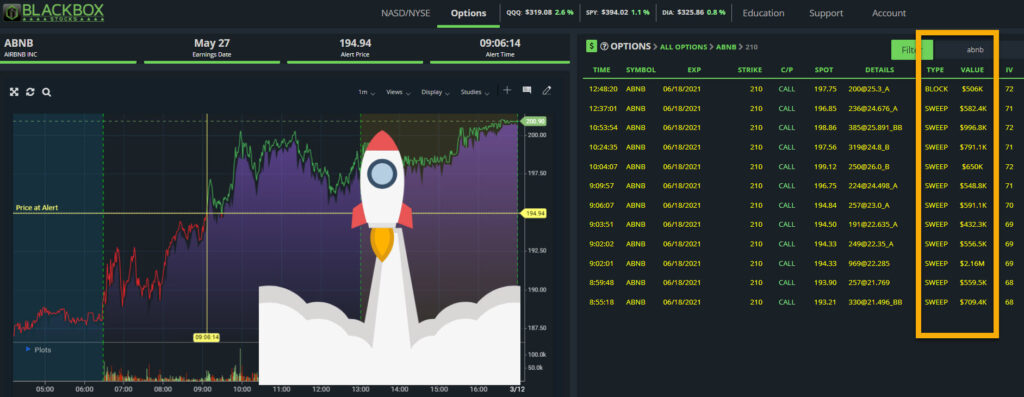

AIRBNB – Original Post: $ABNB

Again no one sold this while they were hitting the flow. Below the bid..nope, don’t think so.

Up about 30% gain

Bonus “flow analysis” from my favorite stock WDC…

Directions: Enter, Take gains, and Smart money exit

Original Post: WDC Initial Post

Oh my…. these guys are selling because its all bid side again.. From the looks of it NO, but at the moment you need to think about it. This is somewhat confusing and yes we can debate about it on the day it came in. I took it anyways.

My exit post : WDC taking gains post

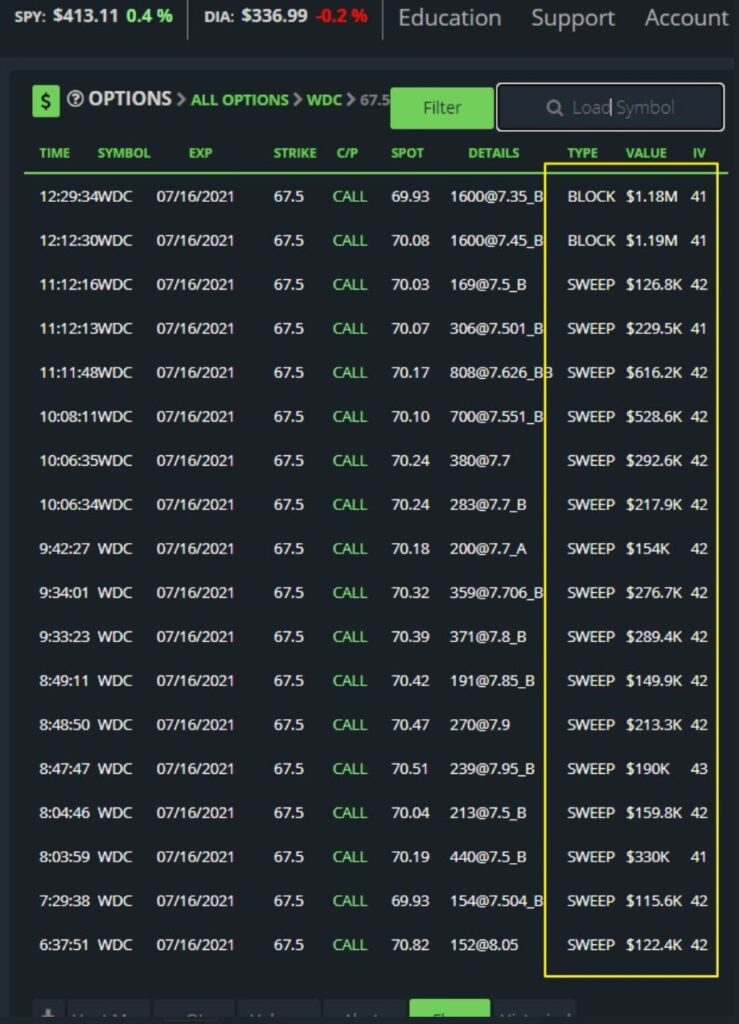

Now this is the flow EXITING

Original Post on twitter : WDC smart money exiting

This is a straight up exit. Textbook.

As you can see these are very good examples on flow that had bid side on them. These plays show you how to read good flow. But I need to empathize that good flow will also fail even if they have bid sides. I just want to show you that do not ignore the bid sides. There are certain criteria but you need to learn. I know someone platforms would tell you these are sells. But Blackboxstocks give you the data and you figure it out as a whole

The platform is just a piece of the puzzle, you also need to learn how to read it. The great thing is, we drill it in your head that you know exactly what to do when it comes in.