Top 3 mistakes in stock trading July 2020

July was a part of earnings month and this is my second time in these situations. Remember I have barley any experience in stock trading except having lady luck in preventing me from making huge mistakes. These are just my top 3 trading mistakes.

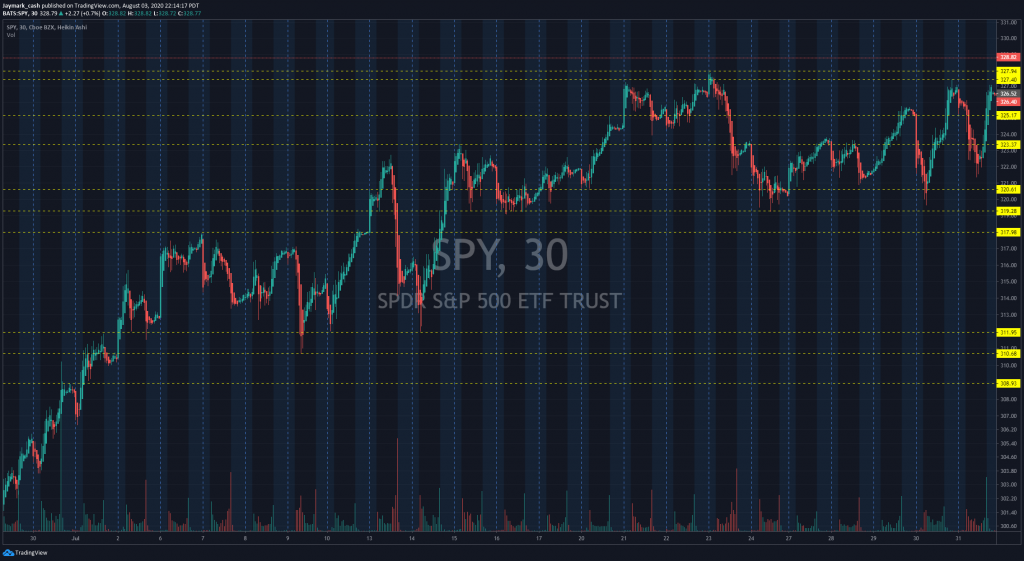

Let’s look at the SPY first to see what happened.

Blue dotted line = Market end, no afterhours

Yellow dotted line = Possible support and resistance.

Summary of chart: The Spy was on a good uptrend and had a few down days specially when trying to hit $323. It was rejected twice in the month before it broke resistance. When it also hit $327, it has been price rejected 4x in the month. However as of 8/3 the chart broke that resistance and this is where there may be a pullback. We have some room to come up at $331 but I feel as there will be a few more price rejections as we go on.

I just wanted to go over the spy briefly so in the future, we can see why I chose my plays.

Top 3 mistakes I made:

1) Not using a journal properly.

This is the reason I made this blog so I can journal my stock trades and making sure I know where every penny goes. I have no problem losing money to a certain extent within my stops or if support gets broken. However I have a problem when I do a really dumb trade and a few hours later I think to myself why did I even do that trade? Every single trade should be recorded!

For example, the above was a snippet of a few days but I did not like the layout. There should also be a notes section. I will be updating this since there are columns that I do not like. The PnLs will also be defaulted to worse case lost.

There will be a new August 2020 that will also be public.

I just need a few more days to figure out what would be the best layout for myself. I been trying to add some google sheet codes to pull from an options chain but having some trouble. But my best advice is get something listed!!

2) Overtrading and Choppy markets

When the market is rallying with tons of option flow, it’s too easy to get caught up in FOMO. (Fear of missing out). Those days can really make you money or they can make you break-even. Mentally when you’re winning you will feel the greedy specially if you’re on the fly.

Do not be greedy and buy them all.

Buy only what you can afford to lose. If your account is limited to $500 per trade due to your risk tolerance, do not exceed it. This is where you have to stop and think while you’re in the green. Some days you can be up 30% then you buy another option that makes you lose 30% because you went on a FOMO.

Nothing wrong with FOMO/YOLO it’s just make sure you’re willing to lose it ALL. 3-4 open option calls or puts is plenty. Once you get over 5, it will get overwhelming because you’re going to have manage them all.

Chop Chop Chop

There are days when the money stock flow is just not coming in. Low volume days and choppy days. From my experience, those days can either make you money very slowly or lose money very quickly. When the market is slow that means the big money is waiting on some catalyst to happen. If you’re going long, then this wouldn’t be an issue but if it’s a short swing, think about your choices. This will also tie in with forcing trades.

It is better to trade with quality flow vs subjective flow

These slow days are also horrible for the options chain because it will cause you to lose a day of Theta.

3) Holding too short or too long

A hard concept to learn because you want to sell when the market is at it’s peak and you don’t want to bag hold (holding stock/option). When you get in the habit of bag holding, it will tear up your account quick. You will lose your opportunity costs. The best thing to do is read the chart and figure out where support will be broken.

Once it breaks support, do not keep holding because your initial trade is now broken.

On the flip side, holding on too short while you’re either slightly green or slightly red will also get you nothing. There has been numberous trades where literally seconds later the stock jumps. Also has been times where once you get your money back and sell off, it will just keep on going. Ugh..well that’s my top 3 trading mistakes.

Otherwise…

Learning the stock market is a journey and this is not really a “get rich quick scheme”. Although a few lucky trades can actually make you a millionaire assuming you have enough money for the initial investment. Such as this one where a reddit trader made money on tesla

These mistakes are just the typical stock market mistakes that happens to everyone. There is NO need to blame yourself, you just have to move on tomorrow and do better. I will end this here as I will keep on trading and here is my tops for the month of July 2020. Just make sure that you don’t make the same top 3 trading mistakes that I have done myself……

This month:

Biggest Lost : -53% while using 11% of the portfolio in 1 trade. GM – General Motors

Biggest Win: +140% while using 22% of portfolio in 1 trade (more like 10% but I scaled down my total portfolio value after the time. PINS – Pintrest