Why not all stock option flow works, here’s an example

Not all stock option flow works and this is a really good reason why it doesn’t. We always brag (even myself) that I made over 100% on a call option within 5 mins right? It’s REAL and there’s nothing fake about it. However on the flip side, you can also make a ton of money and you can also lose a ton of money.

The Blackbox system works by giving up the flow within their algorithm. It does not filter out everything but it’s good enough for someone who can LEARN to read it. We have a popular saying…

90% of Flow is Trash. Garbage.

This is true and here’s 4 reasons why:

-

Someone with 20k can just yolo and trigger the flow.

There’s people with money and can make the flow. A lot of blackbox members are able to do this too and there has been times we seen it. For example this amount is not a lot of money (in the stock world) but it can hit the scanner. Some people are really stupid, they will put their whole life savings in a stock option without knowing anything. If that works out for them, that’s fine but it’s not my cup of tea.

-

Hedging / Advance stock strategy.

I’m not an expert in these debit/credit spreads but if the big boys are opening a position, they might be playing multiple strikes/expiration. So the flow that comes out may be part of a play and you don’t see the full picture. Sometimes we can determine if it is or not but for the most part, we are watching the right flow to avoid this.

-

Stock Replacements.

This is another strategy that big guys can do. Sometimes there’s chances were the guys would buy the option very last minute when it may expire either the same day or next day. Their main goal is to purchase and exercise the option. Sure the trade can work but it may not get a lot of gains, it needs to be just a penny over so they can exercise the option. You’re to see a huge buy and it looks very urgent but they want to keep the premium and get the stock and if they lose that’s fine and within their risk tolerance.

-

Bad overall Market.

If the whole market starts to go in correction mode then your option calls will all go down causing mass selling. Same for political and economical factors as these will drop any stock.

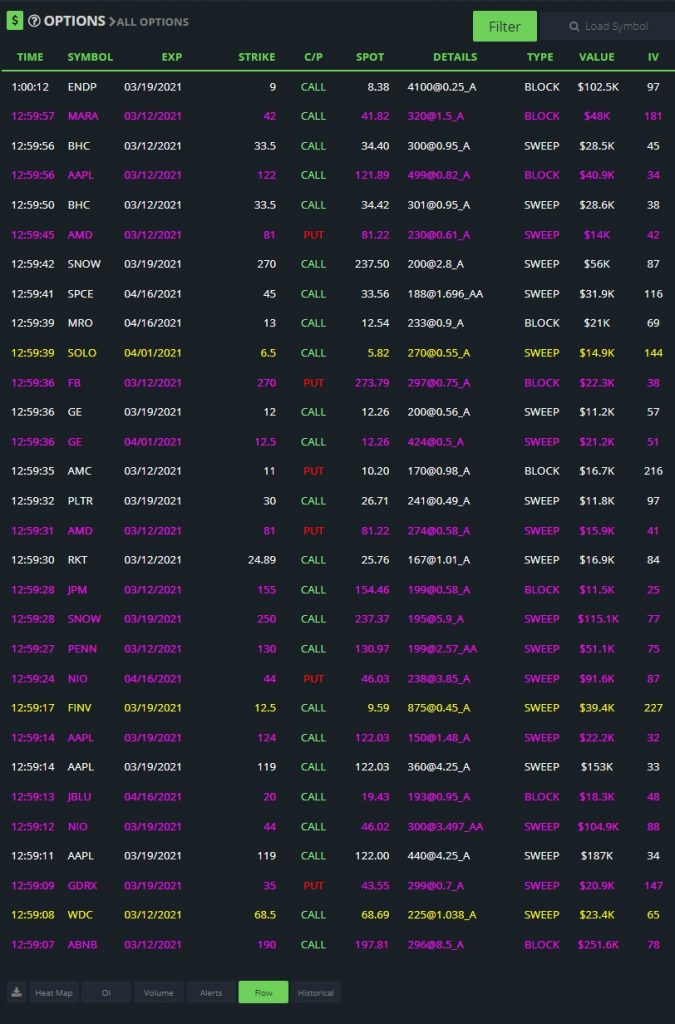

So here’s an example of call flow before market close on 3/11.

This is garbage for the most part because when grouped together there is nothing that stands out. These are considered small dollar amounts since most funds are in the millions and billions. It doesn’t matter for someone would put $102k in ENDP or $48K block in MARA. These are not big enough to count as good flow. Not saying it will not work, I’m saying it will have a lower chance of working.

Compare this flow that we saw on $ABNB (AirBnb).

A flow like this will most likely work because someone put millions in a day. They were urgent to get in and paid the premium. This can’t be your average joe since the dollar amounts are huge. This good flow is what we are looking for.

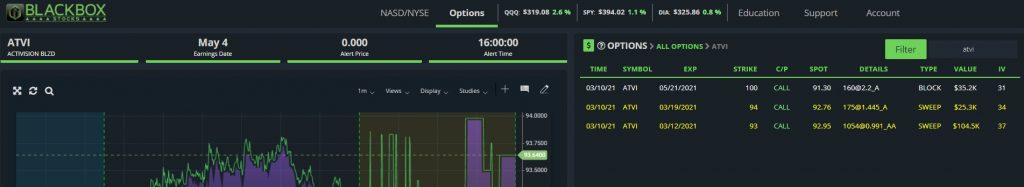

Another flow example $ATVI

Due to the size and mixed flow, this is flow that may or may not work. But we played this because of the urgency and they have been hitting Activision in the last week or so. Also even with smaller flow dollar amount we can try to predict what they wanted the stock to do. Again, this is not a lot of money which is why if it doesn’t work, the one who places the order may let it go to zero.

But see how on the chart, you can try to figure out what they wanted to happen. This may not be the reason but if you put everything together this may be the answer.

Remember that the option came on that day with the circle and it would have to keep going with enough momo to make this work. The contract was already within days to expiration and every second, the contract price will go down.

This give it 2 possible scenarios on why they might have played it.

- Hoping to gap up tomorrow (next day)

- News-driven

However without tracking the OI, we aren’t sure if they sold the same day. It’s another possibility but all we can do is speculate.

So again, we need to never go all out because not all the flow will work

Most of the time if you do a good DD and have some luck you can make a decent play for the day. However you will have to understand that not all option flow will work.