How do you know when to exit a winning stock trade?

This is probably the most hardest question to ask because you’ll never be happy when you exit a stock trade. I see this all the time on twitter or in the discord rooms. It’s very easy to buy a stock but it gets difficult to figure out when to exit. New traders will always have this issue because they are always trying to get that extra few bucks.

The extra 10% you want is never worth the risk

I have been in trades where I got out too early just to see it fly the next day or even the next candle. It has happened to everyone and it’s very common to have a stock turnaround when you get out. So how do we battle this?

Here’s 2 different perspective :

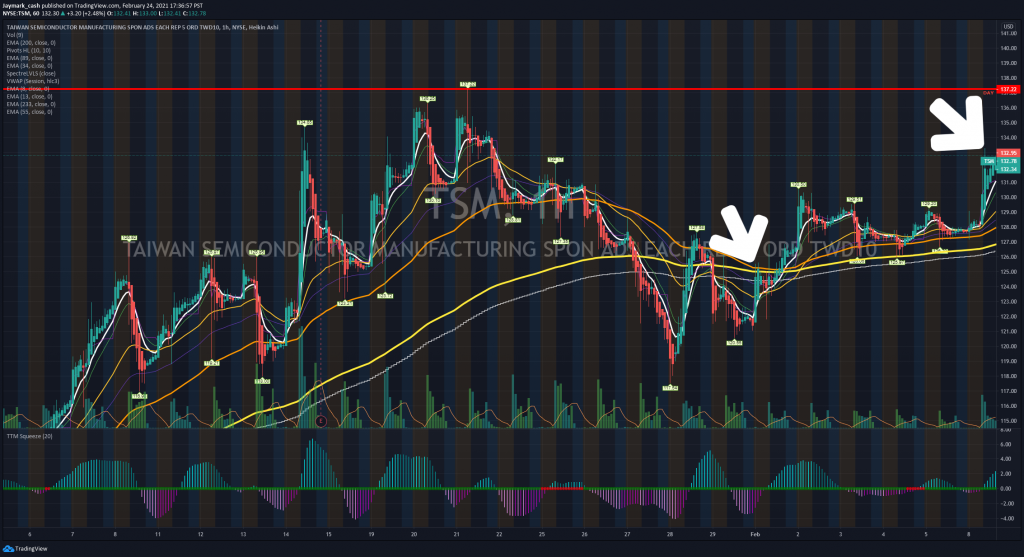

- The Technical Analysis. When the flow comes in and you’re trying to think why they came in and what’s the next move? So for example let’s see my latest TSM play. This is all appox as I did not label this in realtime.

Let’s say you entered in the first white arrow then book profit at the last arrow. You followed the big guys in seeing their million dollar flows. So let’s just say this was a 20% gain (options).

Are you happy with that? If you see in the chart, there is more to come because the red horizontal arrow is resistance. This resistance is from all time highs. The risk is the bottom of either the 200 or 233 (white and yellow) of those dips.

Let’s also assume the market is doing well and this stock is close to ATH. If you got out here, very good! You locked in your profits. You sell into RESISTANCE.

So the question is….did I exit too early? You may have but you did gain and stayed green in this trade. It is also possible that you exited too early because on the chart it shows that it may come back to all time highs and break it. This is never a guarantee.

If TSM keeps consolidating and breaks to the upside with volume, then you have a beautiful play. But you need to wait and hope it doesn’t reverse on you. If all your indicators show an upward trend you have a better chance to winning even higher.

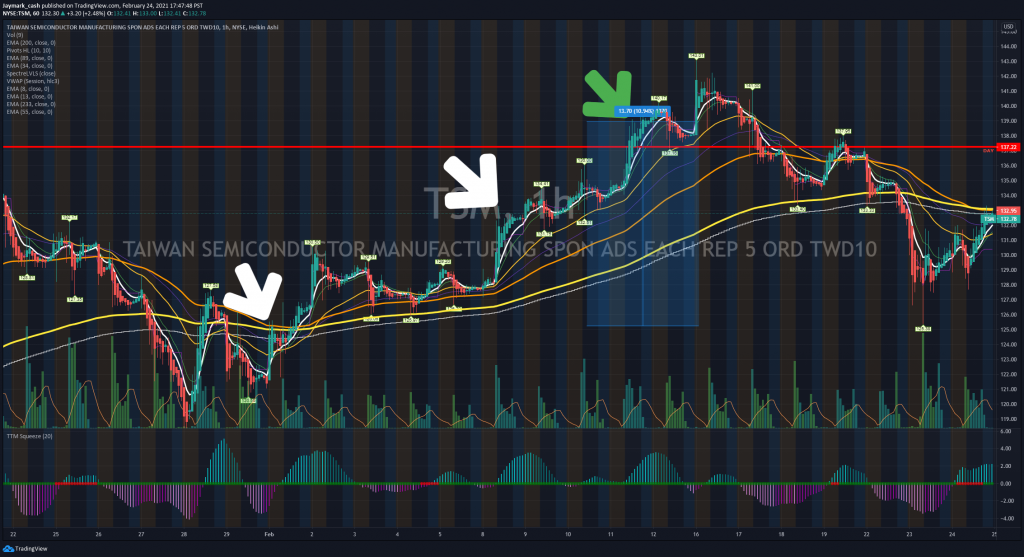

Here’s what happened next and why I stayed in the trade. The chart pattern also shown it has more upside in the stock.

If you stayed longer and waited for all time highs again then you’re up about 11% in the underlying stock and possibly 120% on the option call.

Again read the charts to see where to exit.

2. Mental selling

Very common situation when someone says I’m selling when the stock hits $50 for example. You probably just chose that because you already calculated how much money you’ll make off the trade. This one is tough since us human beings love seeing money. If you’re a robot you see this money with no emotion what so ever! This only comes with experience, emotions, account size ,greed, desperation, etc. We are our biggest enemy.

If you decide that making $100/day is good then once you hit $100 for that day, you’re going to sell. Nothing wrong with that either but the market doesn’t care how much you made. This can lead you to losing the bigger plays because you didn’t let is run far enough. However this can also reverse and go from green to red in one candle. But again if you’re happy then sell it.

You need a plan to exit without trying to use the actual profit numbers. When you start getting in red, you don’t even know when to sell. When you start to panic, you start to sell and you later realize you lost money for no reason. Be very careful and always do your due diligence when buying and selling stocks.

The best way is to use technical analysis and see how the stock behaves.