Examples of the best options flow we find in blackboxstocks

I seriously love these plays and they are one of the few that we can get a few times a week or once a month.

**EDIT after posting : DO NOT EVER GO ALL OUT. TRACK OUR WINNERS/LOSERS FLOW ON THE LINK BELOW**

The best of the best flow or aka Alpha Gold, 20 trades or Golden hammer. They usually have this options flow criteria.

[Try BlackBoxStocks.com and get 20% off First month!]

Nowadays we stopped most of the naming because there are dumb traders out there who will put their whole account and watch it fail. Although this type of a flow has a very very high win rate. Blackboxstocks education teaches you on reading this type of flow (included with subscription). We also show all the flow

There’s more to flow and I will explain on a later post. This is a just a “teaser” on reading good flow.

Imagine eating a cupcake with no cherry. It will still fill in your craving but there’s one thing missing. If you add a cherry on top, it completes the experience. You add a cherry on top.

What is the cherry on top???……..

A Million dollar block/sweep Bid or Ask side.

Lets see the actual flow examples…

The flow comes in quick. We are looking for about a few mins of non stop pounding with some size. We can’t say a specific number but depends on the ticker and once you get adjusted, you’ll know when. For example, $500k in TSLA is nothing vs $500k in a smaller cap or a stock that doesn’t get hit much often with flow. Ignore the TSLA, AMZN,MSFT etc for now. However it can be used for a good TA play if the flow complements it.

NOTES:

-I took the max gains from a spreadsheet that was not updated but may be higher.

– Big money DOES NOT always equal huge gains

-This is old flow just to show you what to look for. Regardless of gains I’m just showing you the flow.

–DO NOT LIMIT yourself to the patterns you see here, you will miss out on others. This is just a very easy “guide”. It’s the very basics to find the best flow.

-Read this if you have questions on bid side flow before proceeding : 6 Examples of bid side flow you thought was a sell

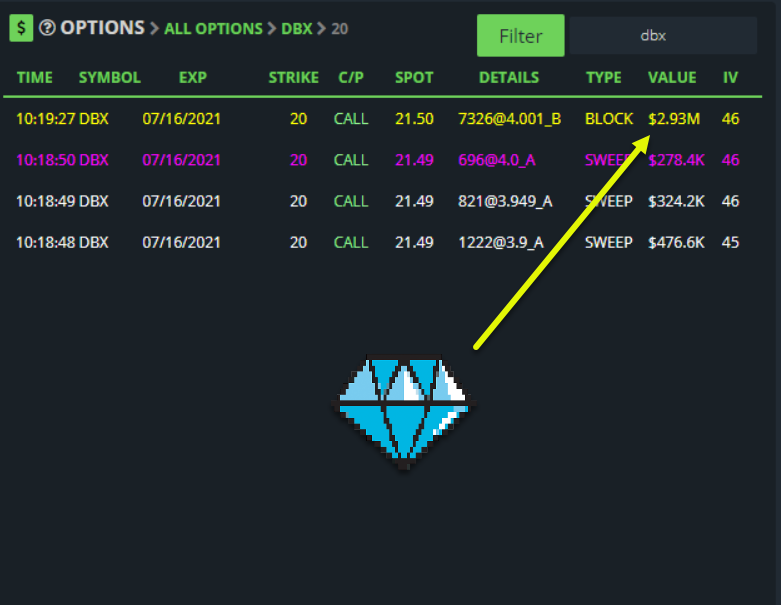

$DBX 7/16 $20 calls +114%

You see the huge bid side block for $2.93M. This was not a sell. This is exactly what we look for.

- Contract price increased

- They added in about 1 mins and all on ask side

- The last fill was the cherry on top the huge block.

- Exceeded OI (more on this on another post, as this describes colors)

Try BlackBoxStocks.com and get 20% off First month!

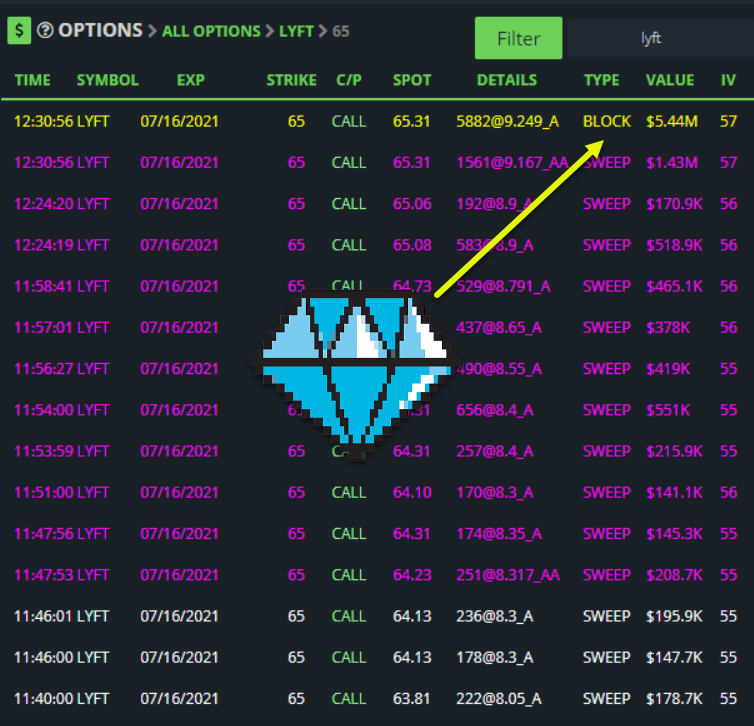

$LYFT 7/16 $65 calls +13%

This time it’s a block and ask side. This one just kept on hitting and the amount of money was crazy in these. There is no reason not to play this one since it was straight up buying for an hour or so.

You see how they come in quick with the same strike and expiration. They don’t take their time and just want to come in.

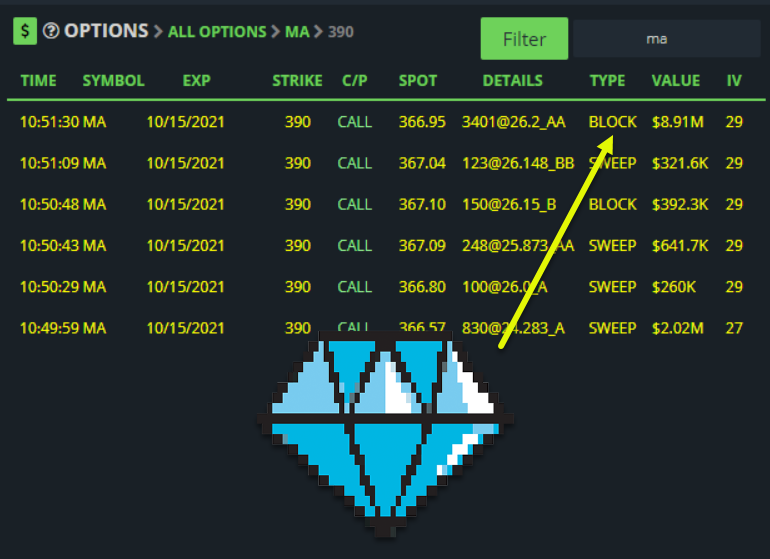

$MA 10/15 $390 calls +173%

These Mastercards were back in March 2021.

THE DRAMA!

I remember the room was going nuts. They basically call out this as a failed flow and they “flipped” it because it was bid side. The drawdown was around 50% or so, I can’t remember. Then a few weeks later skyrockets to 173%.

NEVER NEVER assume that Below Bid is a sell when they are hitting these options like this. If it was a solo block by itself then yes it may have been a sell.

No one flipped to make 6 freaking cents.

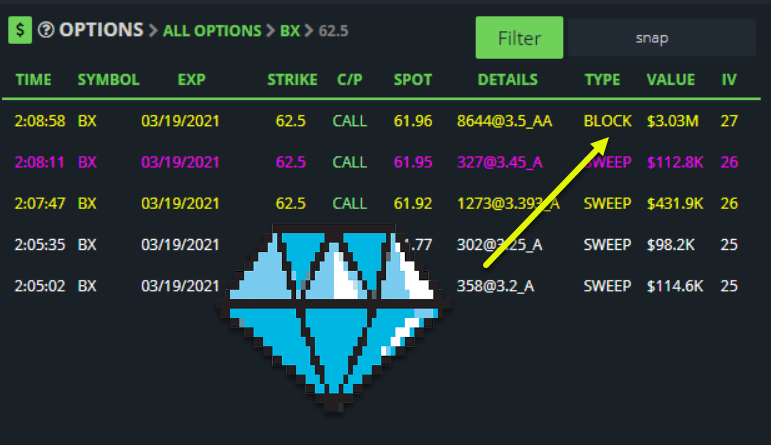

$BX 3/19 $62.50 +172%

The BX flow was golden, we had a recent one that made it too. Again same story here with the $3M block. Cherry on top

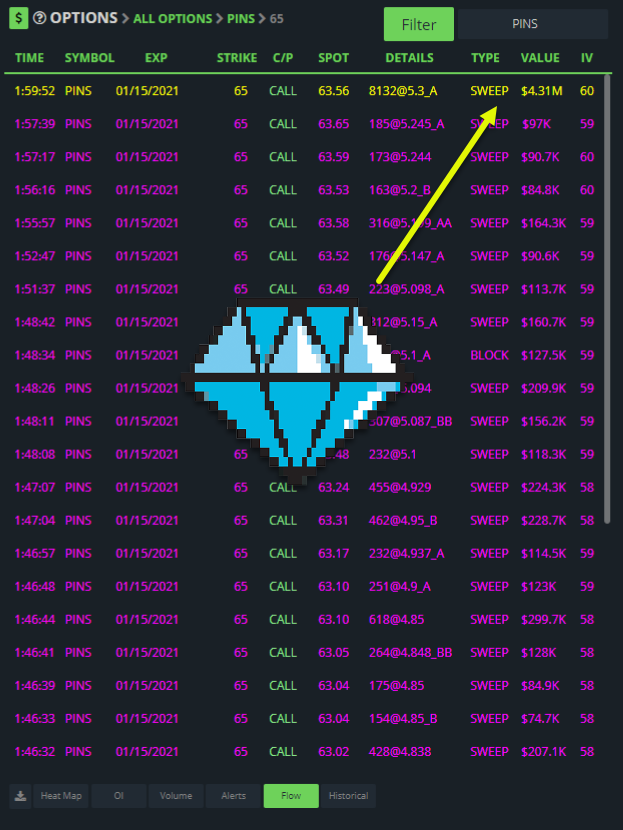

$PINS 1/15 $65 +71%

Let me guess… your first impression is , look at all the bid side. Again look at the time stamps. No one flipped for 2 cents in 9 seconds. However you can tell they are building a position because it took them about 15 mins to fill their order. We can tell because of the time stamps and the contract prices are going up.

To top it off….$4.1M sweeper.

Summary :

As you can see it’s always the same story over and over. You will just have to get used to reading the flow and it will take time. I get the same questions over and over. Is that a bid? That’s a sell! Or how do we know that’s good flow? Just look at these examples and find the pattern.

There’s too much resources and a bunch of us blackboxstocks members to show you the correct path. This blog also shows tons of backed up information on what to look for.

Try BlackBoxStocks.com and get 20% off First month!

Bro, you should show some of the losers. You are gonna have somebody go all in.

I agree 100% with that. This is just to show some sample plays. The most current plays are updated weekly under https://abovetheask.com/options-flow

Appreciate the comment.