How I played $SQ flow with over 120% gains

There’s nothing magic about what I’m about to go over. A little bit of luck played with this and this is another good example if there are “good” conditions. I’m not saying I get these gains all the time, I’m just showing you the POTENTIAL. Eventually I will post on failed ones.

I’m following up because if you watch my video or my blog post on $COUP this is another example.

Example of why letting the chart show your exit $COUP

Let’s start here:

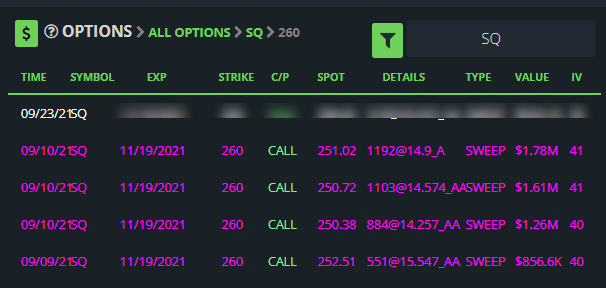

$SQ came in on our scanner

We know this is a great buy. But if this is too much for your account or pushing it, DO NOT buy this. Build your small account with smaller options. I been there, done that.

I was ready for this moment.

First thing I saw was……

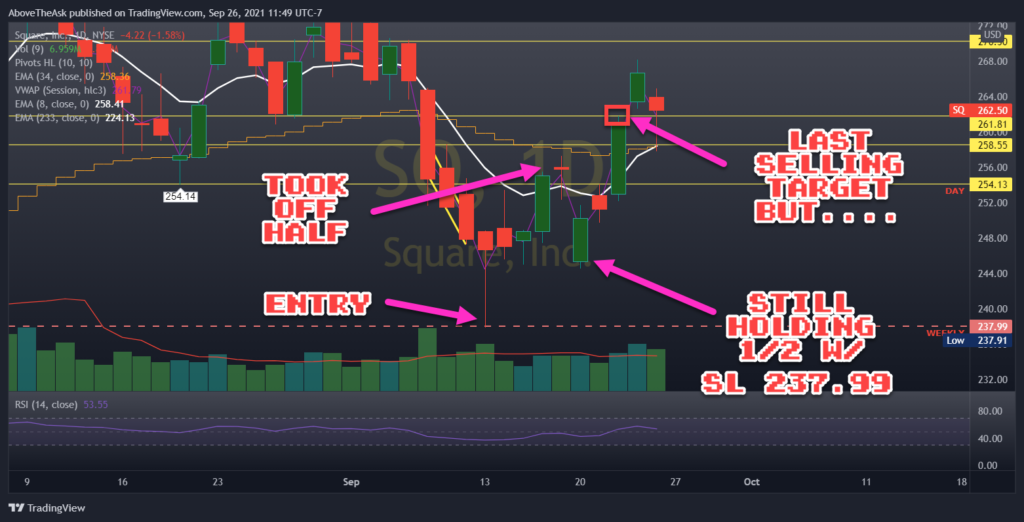

May look confusing but bear with me as I’ll clean this up. I already had a support for WEEKLY support dating back earlier this year. Larger timeframes are major support levels.

Reasons why I didn’t enter right away:

- Wanted a pull back

- Bias about the market selling off

- I saw weekly support

- Didn’t like the chart at the moment

At this time I have a tight stop on this. If this broke $237.91 with volume, my next stop out would be $235.

At this point I have a SL and I’m not watching it anymore.

If it fills and I lose $100 or so. I believe Delta was .45 or so

With this mindset. Let it run. Let it ride.

Remember that the original flow is down $500 a contract. If you entered when the big whales came in, you’re hurting just like the whales. But never leave your wingman. Let it run, stop looking at your P/L because that will ruin you.

Here was my mind set on that day:

- Bought the dip while everyone is hurting

- I have a SL $100/contract. <<– Defined risk for this play.

- There’s $5M in that play (additional confluence)

- First sell target around $251.

- If it chops I’m 100% fine because I bought low

- We have until November

- *****If I don’t profit on this trade I’m fine*****

Looking back at this you can figure out some selling targets. Yellow lines are possible targets into strength.

You can tell that SQ doesn’t have much support/resistance around these levels. So if it runs with volume it can boost itself up on the next level.

But now look at what happened and this is where other’s may get “lost”.

If you moved up your stop at the previous day’s candles you would have gotten stopped out. I almost did and I did post on twitter that my stop for the last batch was $248. BUT the next day, I remove it and added the SL back down to 237.99.

STILL HOLDING!!

WHY? Because I saw this flow.

Not the greatest flow and they may have gotten out but I took the risk just because I bought Square so low that if I breakeven on 1/2 position that is not sold. I’m 100% fine with it. But you need to note if they got out of it, it is for a different strike/expiration. All I wanted to some sort of activity in the ticker.

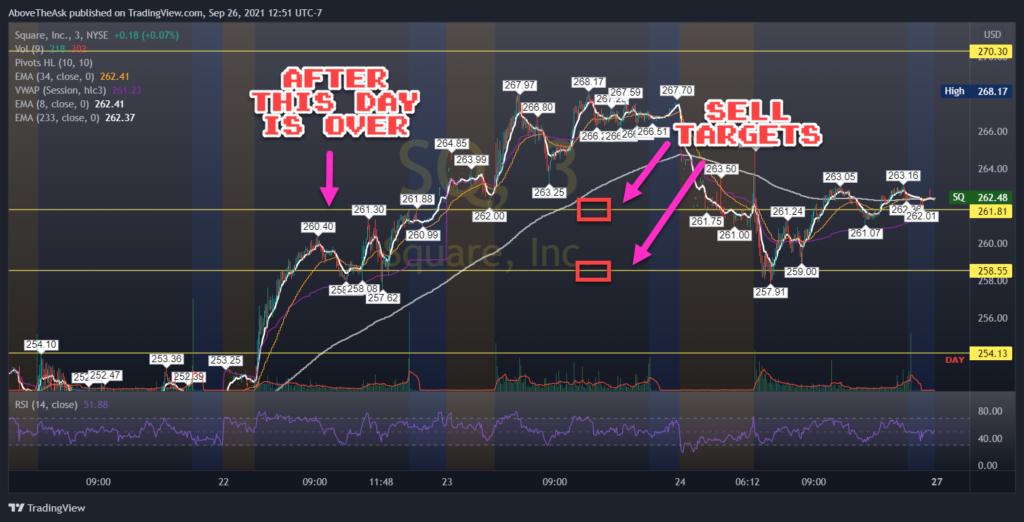

Last selling point.

So at this point over 100% I’m going to take my last few. Below you can see I’m ready to sell on 9/22.

In my head I have already made the decision this is where I’m going to sell. Although we still have until November, I’m happy with this run. It is also now getting at ATM so to max gains you can roll or you can still hold.

I was going to sell on 9/23 but held on because…

Stock replacement. However this helped boost up the underlying stock and the position on the chart was very bullish. I kept moving up my stops until I finally sold off my last position.

I was up where I’m content and I know it may still keep on going. But I’m happy with this trade. I am aware I sold into strength. There is a lot more to go since there has been some bullish flow coming in.

This is where I’m happy with my results personally. I stuck to my plan and didn’t flinch when things were not going my way but still tolerable. Selling from $9 to $21 is quite a ride and I’m pretty happy about it.

What else is there to say when your plan literally worked how you wanted it.