Top 5 reasons you’re losing money with black box stocks

There’s a lot of members in this group specially new ones that are having a very hard time using the platform. They are always losing money even though there is a ton of good plays that you can do. I don’t want to blame new people but you need to learn how to crawl before you can walk.

I started out with blackboxstocks not knowing anything. I mean…NOTHING. I had no idea what “buy to open” means. (No joke). It took me about 6 months to figure out how it works for me. I’m not in it for the quick buck, I’m in this for the longer term as a day trader. More base hits and home runs are bonus.

Reason #1 – Not learning how to use the platform

Spend the time to learn it. I mean spend the time as in dedicated REAL hours. Grab some coffee/tea and turn off your phone to treat this like a real class. I spent over +20-25 hours in a month in the beginning. I watched everything over and over until I can explain it to a five year old. I went though the long homework list and webinars.

Every single piece of information I soaked into my brain just like a wet sponge. As a member I hear the same questions over and over. I get it if you don’t understand after you took the classes, that’s fair game and we’ll be more willing to help you. But there’s certain things that you can easily find answer to in the classes or on google.

The people that complain did not take the classes and we know.

If you can’t figure this out, you shouldn’t be trading

People go to school to become doctors, nurses, firefighters , etc. This is the same thing as trading is also a profession when you treat it that way. You need to learn and discover how to use different techniques as you go. No one will tell you what to trade.

Reason #2 – Too big of a position size

Not everyone will have the same account size and not everyone will have the same risks. Blackboxstocks has some very good alerts and the win rate is well over 75%. But remember, I said that it is NOT a perfect system and it will fail. Traders end up dumping half their account in a trade and do win big. But they try it again a 2nd time and that trade fails which leads to you blowing your account.

When a play is RED even for 1 day and down 10% a lot of people freak out. It’s very astonishing how many people complain and end up selling their position because it was too much for them.

You need to manage your trade.

In the beginning I have lost so much money because I sized up too much and sold it just to find out a few days later it goes up 50%.

I keep my play size private as this will not affect the outcome from my blog posts. I can tell you I put $5k into an option call and if it goes to zero, I don’t care. However there will be that idiot that dumps his whole account because he saw me (or someone else) dump a “big amount”.

That big amount may just be pennies to people while that’s your life savings. I seen some members go in $10k,$50k,$100k deep in these options but that doesn’t mean it’s a GOOD or BAD play. I seen members with $5M accounts so $10k option play is NOTHING.

Here’s my tip :

Find out the size that is comfortable to lose. This may take a few lessons of losing but eventually you will find out where your sweet spot is. Once you get to the point where you can trust the flow and your own TA you will eventually learn where to take the L.

All of my plays, are small enough that I can sleep at night. The market can turn red and I’m very comfortable losing what I put out. I’m also trusting the flow with my TA.

Reason #3 – Puppy Trading

Stop trading every alert and call out. There is no reason to play it all and you’ll end up losing all your money because you can’t manage it. I’m waiting for that comment saying…..but but but, you said the flow works most of the time. Yes it does! However if you have 10-15 positions open with all different strike prices and expiration you will be so confused where to exit. You’re also going to be so distracted by all the other stocks that you can’t see where a failing stock can lie.

By the time you figure out it may be too far out for you get out of the trade.

What will also kill your account is if you have 20 positions open and we get a red week, yeah have fun with that buddy! You’ll end up either selling early because you’re stressed out of bag holding for weeks.

Focus on quality flow and quality plays and you will do just fine. You’ll have a lot of support from the members and mods of blackboxstocks that they will give you advice. But in the end this will be up to you on how to execute your plan.

Reason #4 – Options expire further date in time turns red

This one is real funny and I’d like to face palm this every day when I hear people talking about the flow is down.

Let’s say that today we get an option call to June (it’s Feb) with a decent size and a good strike price. So let’s say $5M of flow comes in and it’s up for the day. YAY! right? For some reason tomorrow, the market is GREEN but this stock call option goes down -20%. Everyone starts to freak out and the world is ending. You go online to find news and you still find nothing. Nobody can explain why it’s going down, that’s just how the market works.

The option expires in 4 months and you’re worried about it today? You need to give it time to work. There’s a reason someone bought months away and those people with the millions aren’t dumb. So give it time and ride it for a few weeks or month. It will most likely work in the end.

This is the same thing as looking at a 1 min chart to find your entry but your option is months away. Today’s 1 min has nothing to do with the longer term option expire.

Sometimes you get lucky and it works the next day. The main point is to get out before the big guys get out with a good profit. Don’t freak out when you still have time left.

Reason #5 – Overthinking reading the flow

When I was still new and we had less members back then too, the mods one night kept saying..

“You guys are making flow trading hard than it really is”

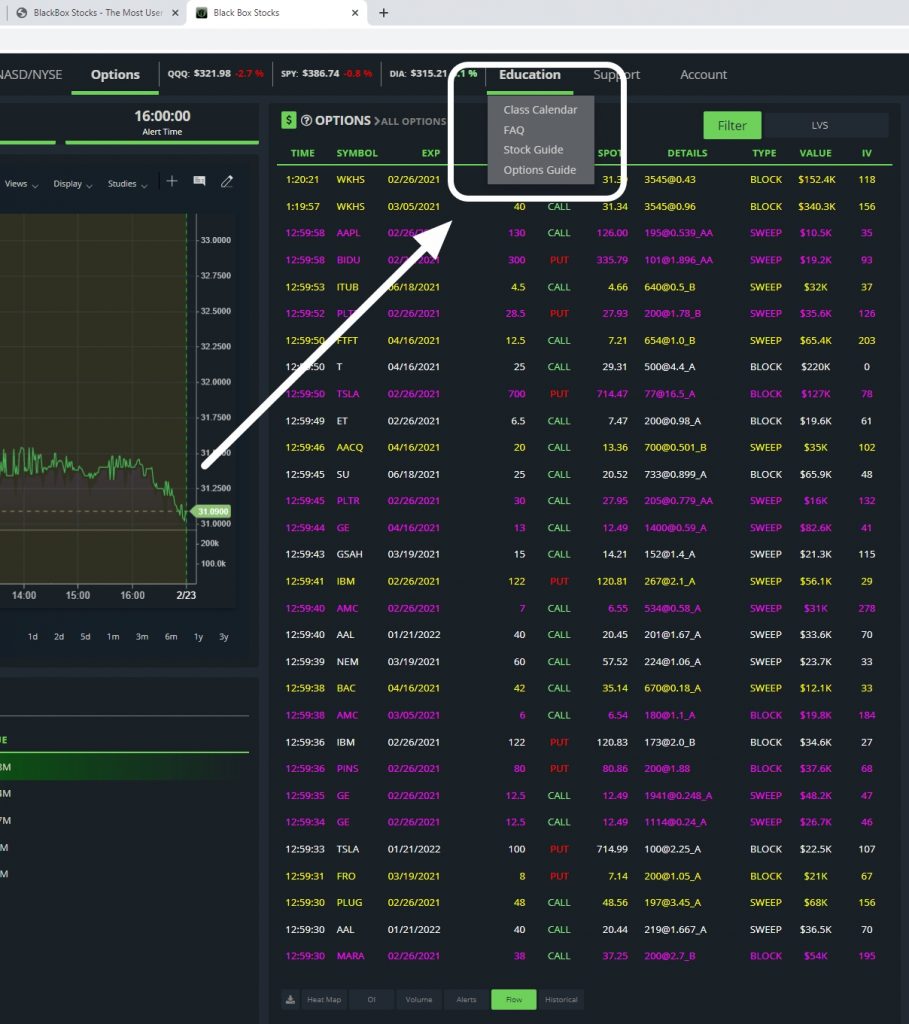

This one stuck to me HARD because I processed too much information and it was overwhelming. When you learn the flow, there are things you need to look for and they need to match up but it also has to be with a criteria. The options alerts, don’t even look at them because they are just something that you should look at but not play. It just means “hey look at me, am I good or not?”

The flow is really easy to read when you get the hang of it and there’s so many of them. Again they all do not work but we need to do our best guess.

If there is flow and you can’t figure it out within a few seconds, just let it go. Do not force the trade because more often, it may fail. What we want with the option flow is get the quality ones to filter out the bad ones. Like what they say in the room “most flow is trash”. The flow has a certain pattern that you will see every single and will work out.

Same stuff over and over and you’ll eventually get it.

I’m not mocking anyone and if you really are struggling we can always help. The mods and members like myself help each other but only if you tried to understand but you still can’t figure it out. Just don’t waste our time by asking questions that are literally 2 clicks on youtube.

Before this blows up in flames, here’s an example to ask a question

What is a B on the flow?

OK this question you will literally get flamed as it’s in plain sight. There is no excuse on not finding the answer. Now a more better question would be..

If there’s a B on the flow but mixed with A, this is not selling right?

You may get some additional flames but at least we know you’re trying to learn. 90% of the questions asked area always in the chat.

Just keep learning and you’ll get it and we fully support beginners but I just listed 5 reasons that I personally have done.