How we played $LYV calls and maximized our gains

The following will be how we experimented with holding longer and “moving your stops”. I keep emphasizing this as it works for me but it may NOT work for you. I previously wrote about a similar set up

Example of why letting the chart show your exit $COUP

How I played $SQ flow with over 120% gains

Just to be fair. I did NOT get to play the initial flow. I played the 2nd round. I’m trying to be 100% transparent and being honest. However I did post we are going to track it hypothetically But regardless if I played it or not, the way it “could” have been played is still the same. I do agree with emotion etc and it does play a part in a trader’s life.

The following is a complied list of my tweets with some input. So be aware that you may have already read these. I made it lazy proof so you don’t have to keep clicking.

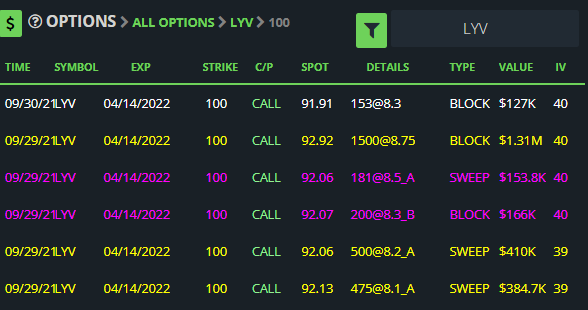

Initial Flow 9/29:

My personal checklist to go long on good flow (ideally)

- -Fits all Blackboxstocks criteria

- -Over 4-6 months of expiration

- -Will hit ER in 1.5 months + one for next year

- -Chart has some confluence

If I’m sizing up I want that expiration to be further out and ER over 1 month. This will give time if the market decides to go against us.

I will always play big money flow, I just lean more if we have more time.

10/1 Huge bullish candle

–>We want to see this and we do not want to sell yet.

$LYV – [Live Nation] Expires 4/22. I missed this one as I didn't see the bigger picture

👉This is an example of options with MORE time but WORKS almost instantly 🥬

– This may be a longer term option for them

– They may roll in the future

– More time = safe

– May keep going 📈 pic.twitter.com/Lj6f8dcEc3— AboveTheAsk___ (@abovetheask) October 3, 2021

You can read the original thread on the bottom: https://twitter.com/abovetheask/status/1447284085911527430

$LYV (1 of 5) Let’s watch this one for holding flow longer. I’m in no position this is just for educational purpose and will add my thesis to it.

Summary so far:

- Bullish breakout w/ volume

- Held new highs

- Possible bull flag

(2 of 5) Your options $LVY if you bought 3. (just for example I know its $800) -Sell on strength on the huge candle on 10/1 +40% -Remaining 2 you will cut if it almost turns red -$93.24 is SL for the last 2. -Target #2 is 104.23 (fib ext) -Do not sell if it stays above 8EMA

(3 of 5) -Break of 8EMA you can choose to sell -Close below 21 EMA or 93.24 our plan is broken Ideally what we want is sell the 2nd one at APPOX $104.23 with moving SL while watch PA. Once the 2nd one is sold off. LEAVE the runner and let it BE OR sell before ER.

(4 of 5) What are we risking since we already profited? Initial pop is 40% = $320. Today you can sell all 3 for $960. Your new risk for 2 is $640. (assuming never gaps down) to make it double? triple?

(5 of 5) We also know lower end of the flag will run this down to appox 10% gains. Are you fine with that? If our plan fails, your 2 contracts will still sell at a profit. Another factor is the “whale is still in”. Try your luck. Hope this helps hodling!

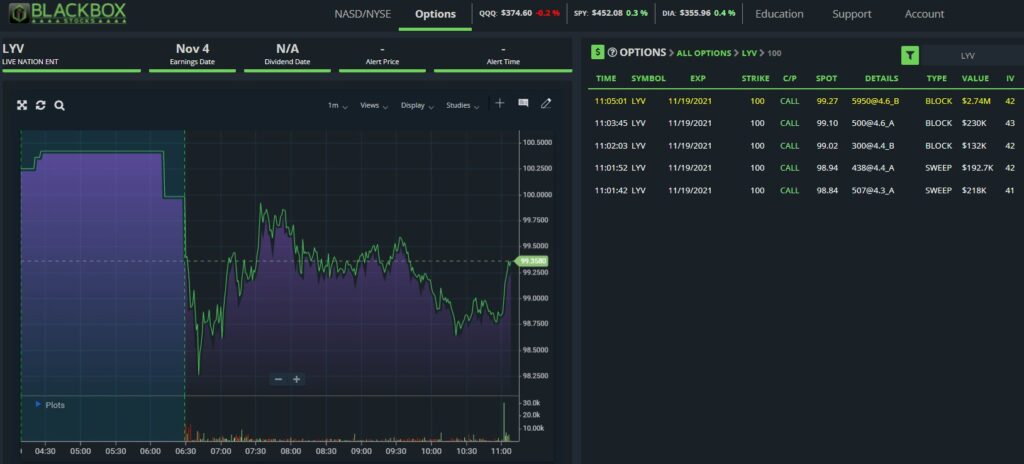

$LYV 2 days. Update (see thread for history). Remember we are seeing how long we can hold until we get stopped out. Assuming we sold 1 (+40%) with 2 pos left -Hit EOD today $800k weekly (sneaky white) -SL we can move up or leave at $94.51 -New support $97.50 -Possible breakout

$LYV 1 week update (see thread for history) Hypothetical hold 2 since we sold 1 from initial pop. – Hit ATH w/ market participating – SL you can move it to $94.51, $96.42, $98.77(risky) $104 Pull back or gap down, possible worst case is stopped at $94.51 or BE.

Took these $LYV $4.63 Our journey isn’t over. Read this long thread as we been following this before the break out. Has started beginning of the month. After the initial pop it never went red. 9/29 – (4/14/22) – $100C I’ll update this thread again this week.

$LYV Just something to look at. Let’s see where this lands today on volume. This is still holding $101. We may get a pull back.

So once I got in we didn’t really move and the price just compressed and consolidated. (See the chart below the tweet)

$LYV – Got stopped out on these B.E.

ER is next week, rather just move on. Price is getting compressed and can go either way.

Run up to ATH or pull back to the 21EMA ($98). Pull back wouldn't be too bad but you're risking up to ER https://t.co/SSYT3hzEQt

— AboveTheAsk___ (@abovetheask) October 26, 2021

The reason why I stopped out. As you can see price was consolidating for a few days and it has moved up from the last few days. If ER wasn’t so close I would have held it. But the risk at having a position when a move has already happened and they added wasn’t worth it.

If the market moves against us in one of those days and it dips right before ER, you’d be at a loss.

Was it worth the risk reward? No. Did the flow work if held? Yes.

In summary if you look at the chart and you were in before the bullish candle, you’d be up 400% IF you played through ER. But we don’t play ER so you’d still be up a decent amount.

Notice below that the momo just kept on going and never actually went below key support areas?

The whales that were in these are up pretty decent. They held as far as they can and as of 11/8, they are still in them.

What you need to get out of this is make your plan and IF/WHEN it fails, you’re going to get out. In this case were barley stopped out.